IoT is no longer a domain that impacts the B2B side of business only, but it has also an effect on smart consumer products as those become increasingly connected, such as coffee machines, trail cameras, various trackers for pets, kids, etc. just to name a few. Whereas many consumer devices in the smart home environment use Wifi to connect to the internet, we see an increasing trend that cellular connectivity is getting a fair share.

Those consumer products using cellular connectivity and distributed via retail channels are often shipped with IoT SIM Cards packed into the box or with those already installed in the device.

Despite supplying a fully functional product with IoT connectivity included, this process has many technical and regulatory implications that any retailer of a connected consumer product needs to consider.

This blog outlines three areas of concern for those cases where an IoT connectivity service is provided in combination with a consumer product as a total solution for end-users. Those concerns are:

- implications of taxation, with special implications of EU regulations and other market specifics

- validation of end-users identity as a requirement in many markets for the provision of telecommunication services

- multi-currencies and market-specific price levels

Please note, that this blog does not take into account any considerations of particular use-case requirements, and does not act as a replacement for a tax consultation, but… it will present you some of the main concerns and possible best solutions.

How is VAT calculated for IoT mobile data services?

Unlike any other electronically provided services that normally include the tax of the country where the end-customer uses it, in the European VAT (value added taxes) regulation it is stated that the place of service performance is identified by the mobile country code of the IoT SIM Card paired with the connected consumer smart device. Hence, in case the card is being used in roaming and within the EU, the taxation is shifted back to the country of origin – the place of service performance of the telecom operator who issued the M2M SIM certificate.

To illustrate this matter, let us consider the following examples:

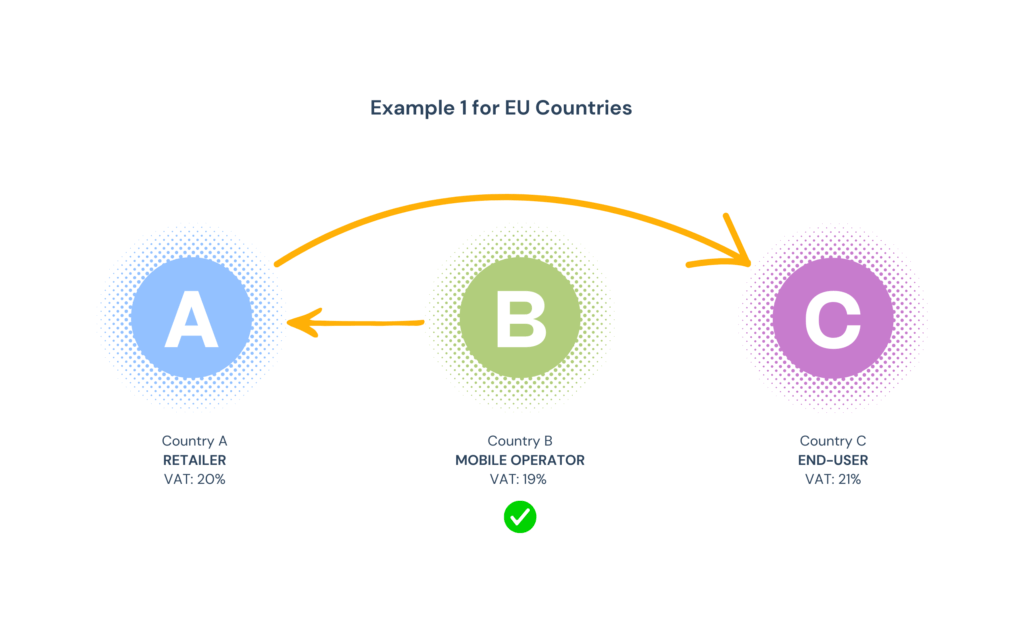

Example 1

A retailer of connected consumer devices located in an EU country “A” sources an IoT SIM Card from a mobile operator in EU country “B”. Let us assume that the VAT in country A is 20% whereas the one in B is 19%.

The retailer gets an order and ships the service to an end-user in EU country C, where the VAT is 21%. The end-user registers at the retailers e-commerce platform and buys a mobile data plan. In this case the invoice for the mobile data plan, will be issued with a VAT of 19% as the service provider is located in the country of the IoT SIM Card.

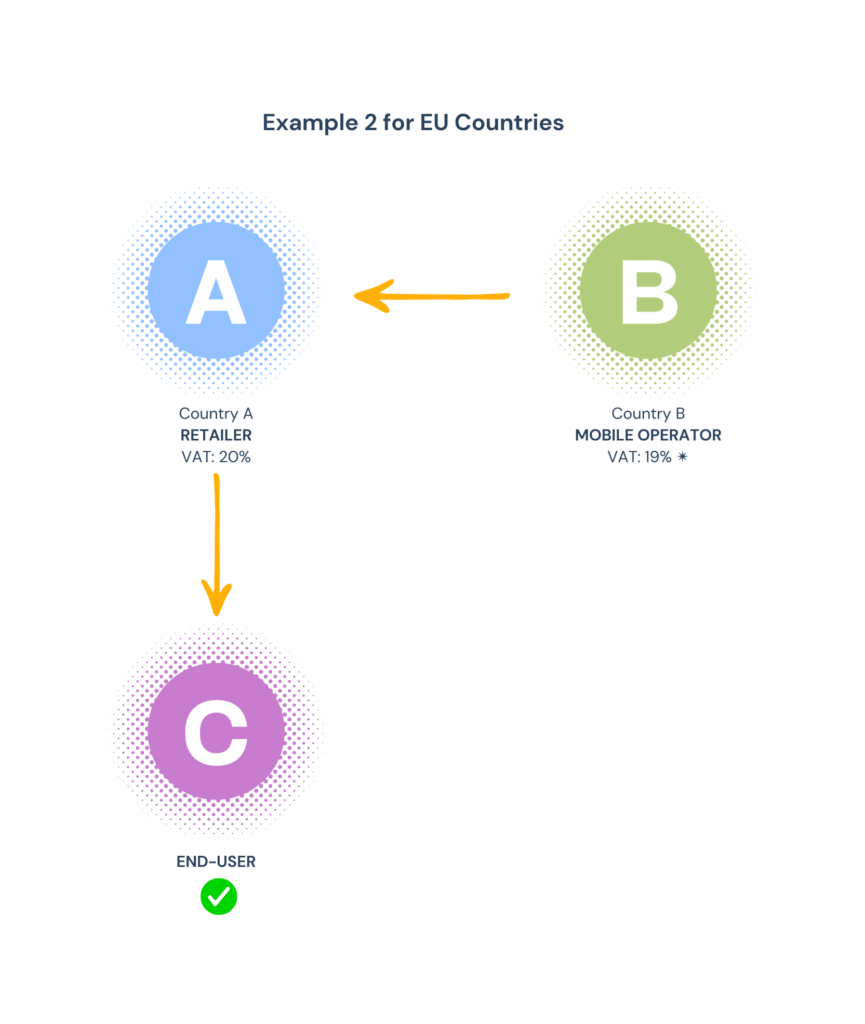

Example 2

Similar to the above, but the end-user is located in the same country as the retailer. When the end-user buys a mobile data plan as both reside in the same country, the VAT of country A with 20% will be used.

* This will only work if you can determine in a few different ways that the end-user is also located in the same country. If you prefer to avoid the effort of finding out, you will charge 19% tax.

Both cases above illustrate the situation in terms of VAT, for services performed within the EU. The complexity even raises if, for example, the IoT SIM Card is issued outside of the EU territory but is being used within the EU. In this case, the “Use and Enjoyment Rule” may become applicable. There have been cases handled by the Court of Justice of the European Union (CJEU) and you can read in more detail in the following EU VAT on roaming services.

In other regions, the situation is even more complex. In markets like Brazil or the US, either only local IoT SIM cards can be used within the country due to permanent roaming and tax restrictions (Brazil) or the tax regime is so complex that for each transaction, the applicable VAT must be calculated separately (the US).

Validation of End-User’s Identity

Effective from 2021 on within EU countries, the end-user’s identity must be validated when using telecommunication services. With this regulation, identifying end-users becomes necessary for prepaid IoT SIM card services. This validation can be done either by presenting a passport or ID to the service provider, or through electronic identification methods.

The following data need to be captured from any end-user using telecommunication services: full name, gender, academic grade, and date of birth.

In case you use electronic authentication, the following methods are possible and shall be integrated to any E-Commerce App provided by the retail channel or IoT solution provider:

Photo Identity verification by using a smartphone, tablet, or any other internet-capable device. The SIM-related identification of MSISDN (the phone number which identifies a device during calls or data sessions) and IMSI (International Mobile Subscriber Identity) must be provided.

Verification via Bank or Financial Institution – Bankident, in case your bank or financial institute is integrated with your verification provider, your end-users can use their Bankident to validate their identity. The pre-condition is that the end-user’s identity was previously verified by their bank or financial institute.

Currency Support

Usually, consumer goods are sold globally as opposed to a single market. As different markets have diverse price sensitivities, this should be considered when selling cellular mobile data in combination with an IoT-connected consumer device.

When setting up mobile data plans for the end-user, the system provides prices in various currencies and price levels. When a new end-user registers, the system recognizes the geolocation of the end-user and presents the mobile data plans with the adequate price level, currency, and VAT for that specific market. The automatic association with the end-users region can be done either through the address provided during the registration process or through the origin of the IP address of the connection.

The Freeeway IoT Monetization Hub addresses this topic through distinct accounting groups that relate to particular regions. Each of our partners can select different accounting groups and define prices in their retail channel, adjusting it to the particular use-case requirements.

The solution to IoT Taxation, Currency Support & End-users Identity Validation

When monetizing mobile data as part of a connected end-user device, the specifics around taxation and end-user ID verification, as well as different price points need to be considered before those devices are brought to the sales channels. This can be complex depending on the geolocation of the service being sold and is an issue that is often faced at a later stage of the process, for instance when the product is already being put into the market. This leads to delays in the launching process of new products and thus a longer time to see any revenue.

At Freeeway we have encountered this painful route since launching our B2C brand simHERO back in 2018. We found many solutions – which are now put together into our IoT Monetization Hub, where we provide all the processes and integrations for businesses that want to offer IoT connectivity as part of their connected IoT products and services. The 3 main topics discussed today around IoT connectivity taxation, end-user identity validation, and cross-country currency support are provided as part of Freeeway’s IoT Monetization Hub, enabling you to focus on your own smart products and services.

Monetizing the IoT data of your smart products can successfully provide more value to your business. At Freeeway, we support clients so they can focus on making great products! Connect now through the form below and an IoT Expert will contact you right away!

Your form entry has been saved and a unique link has been created which you can access to resume this form.

Enter your email address to receive the link via email. Alternatively, you can copy and save the link below.

Please note, this link should not be shared and will expire in 30 days, afterwards your form entry will be deleted.